German Tax Identification number explained

The tax identification number is a permanent and nationwide uniform identification number for people who are resident in Germany. The tax ID has 11 digits and every German citizen receives it automatically at birth or upon registration in Germany. Further, as a foreigner you receives it as after you register your address at Einwohnermeldeamt in Germany. When you start a new job, you must give your employer your tax identification number so that income tax can be deducted.

Read Here: How to register your Apartment (Meldebestätigung)?

Unlike the tax number, the Tax ID does not change and remains the same throughout your life. This number will remain permanently valid and will not change, for example, after relocation, after a change of name due to marriage, or after a change of marital status.

Tax number is the one which you get from your Finanzamt after you file your first tax declaration. It can change every time you move to new city with a different Finanzamt.

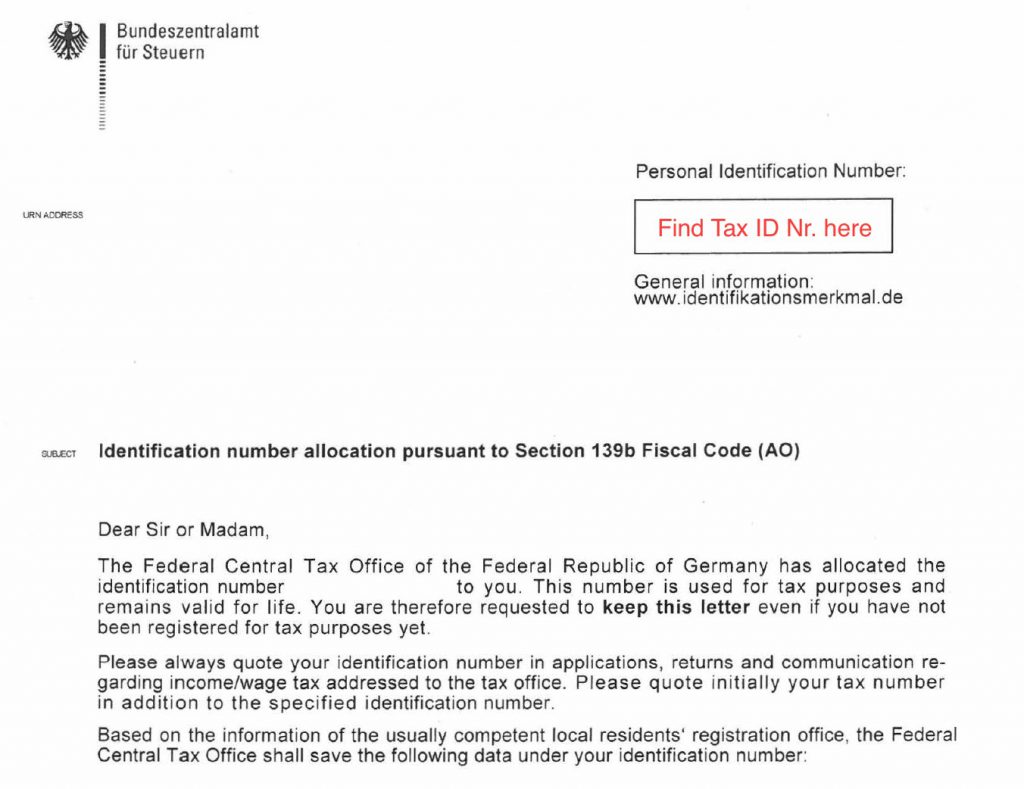

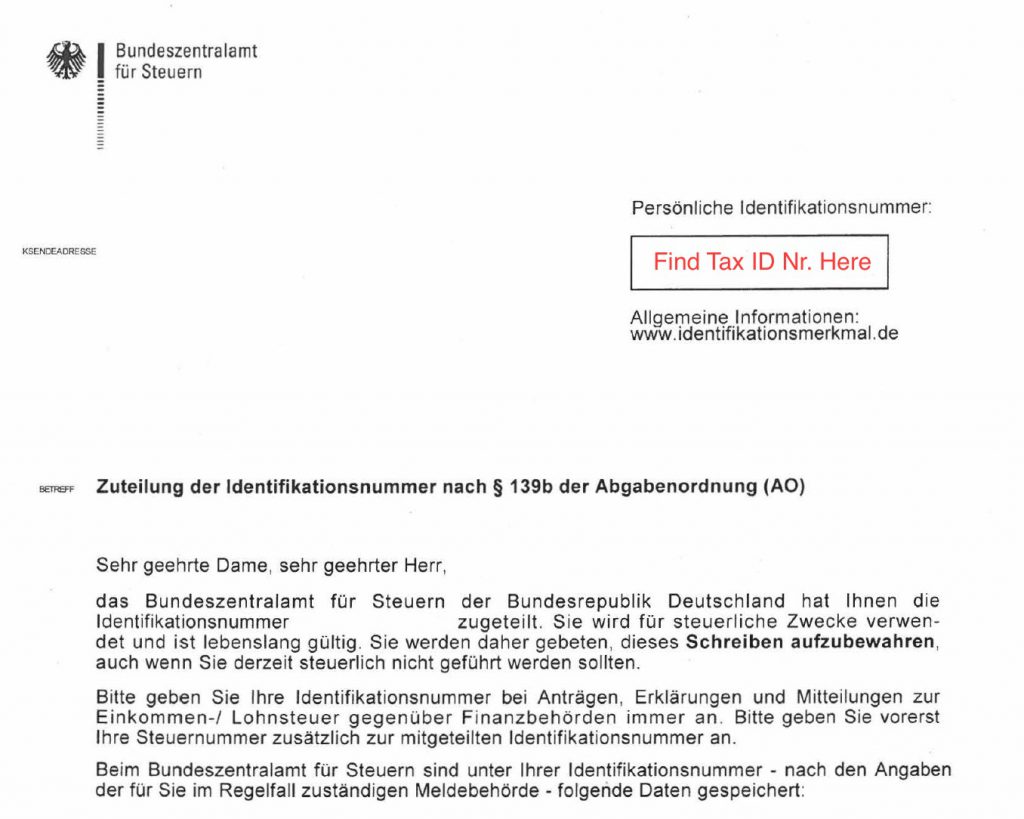

Get Tax IdNr

After your first registration of address at Einwohnermeldeamt (Resident’s registration office), you will receive yout Tax ID via post in around two weeks. Make sure you have your name on post box. If you still don’t receive it, you can request it at your local Finanzamt (Tax office) personally or via online from Federal Central Tax Office (BZSt).

Eazyleben Tips

- The Steueridentifikationsnummer, Steuerliche Identifikationsnummer, Persönliche Identificationsnummer, Identifikationsnummer, Steuer-IdNr., IdNr or SteuerID is your unique, permanent tax identification number.

- If you don’t provide tax ID to your employer, you will be taxed at the highest rate and which you can claim back eventually during tax declaration.

- If you are in minor Job, the tax ID is usually not asked for, as no taxes have to be paid.

- You can also submit your income tax return to your tax office without an IdNr. Your ID Nr. is already known to your tax office.

- Persons who are not registered under registration law, but are taxable in Germany, also receive an ID number.

- In the case of married or partnered taxpayers, the ID number of the spouse / partner is added to the IdNr of minor children, provided that they are registered in the same municipality as the taxpayer.