Refund of Pension contributions on leaving Germany

When you live outside Germany or intend to move abroad from Germany, you might ask yourself how a move abroad will affect your future pension or your previously acquired pension rights. The European Community regulations apply in the member states of the European Union and the European Economic Area and in Switzerland. So you cannot make a refund claim as long as you are in EU/EEA/CH.

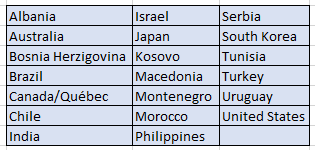

Germany has also concluded social security agreements with numerous countries (contracting-states). i.e. if you work in a contracting state, you can add your former German pension Insurance contribution to your current pension scheme in contracting state.

Read Here: How to move to other EU nations with Daueraufenthalt-EU?

Remember that only employee contributions (Arbeitnehmer-anteil) are reimbursed (~ 9.4% of gross salary), not employers. Another alternative to claiming back is to simply wait until you are 67 years old and then have a pension paid out by the German state. According to your nationality, this will be done regardless of which country you live in.

Are you qualified for a Refund Claim?

Various non-EU citizens can claim their German pension contributions back if they have paid contributions in Germany for less than 5 years (60 monthly contributions). The claim can only be made two years after leaving Europe (EU/EEA/CH).

How to Claim a Refund?

Following documents should be sent to the responsible pension office (Deutsche Rentenversicherung Bund/DRB) in Germany-

- Form V0901 (Download Here).

- Certified copy of passport and other supporting documents (driver’s license, utility bill or bank statement).

- Meldebescheinigung zur Sozialversicherung from German employer for every year employed in Germany (Social Security Record Booklet).

- Ausdruck der elektronischen Lohnsteuerbescheinigung for every year worked in Germany (Certificate of total contributions number).

- Copy of Abmeldung (Final De-registration), if any.

- Other proof of Insurance, if any.

Read Here: Get your Free statement of Contribution to Pension fund in Germany here.

Make sure you have attached all the relevant documents as per the check list in the form V0901 (section-12 & 13). We would recommend it over a safer side rather than DRB getting you back and requesting further for more document as it is time consuming. (For USA and Canada, following additional forms are required: A1312- only for USA/CANADA, A9060- only for USA)

Send your completed application here (may change depending upon your last residence in Germany)

Deutsche Rentenversicherung Bund

Ruhrstr. 2

10709 Berlin

Germany

After successful submission of above documents, you may expect a confirmation letter at your current address from DRB in 4 to 8 weeks. If your current country of residence has a social agreement with Germany, then you can add your German pension contribution to your current pension scheme, so that the insurance periods you have acquired in both states will be added together which may result in you being eligible for a pension when you have reached pension age. Or else, you must reply to confirm that you still want your contributions to be reimbursed.

DRB contact for any queries (You can also mail in English)

DRB will also answer your queries if any via Email.

meinefrage@drv-bund.de

We wish you all the best!!

Eazyleben Tips

- Your approximate Pension refund should be the sum of Arbeitnehmer-anteil (Row 23, yearly Lohnsteurbescheingung) for each year of your contribution.

- Your Application and other related documents are better to be certified by a consular officer or a notary. So, get an appointment with your local German consulate for the same. Further, you can confirm any missing documents.

- Only months in which you made contribution to Pension fund calculate towards five years.

- Months where you claimed unemployment benefits also counts towards 5 years.

- Non-EU citizens should also take care that working in other EU nations can also count towards 5 years period in Germany. So better plan before and consult the pension office.

- If you have paid contributions for more than 5 years, you cannot claim a refund. Instead, you can claim and receive a monthly pension when you reach German retirement age.

- Before sending the application, it is advised to check the German consulate website for your current country of residence for any additional documents, if any.