Kurzarbeitgeld-Calculator

Kurzarbeit or Short-time work is a German labor policy measure to safeguard jobs in companies threatened by temporarily poor business conditions. In place of an otherwise necessary termination of employment for operational reasons, the working hours are then reduced and wages are lowered accordingly.

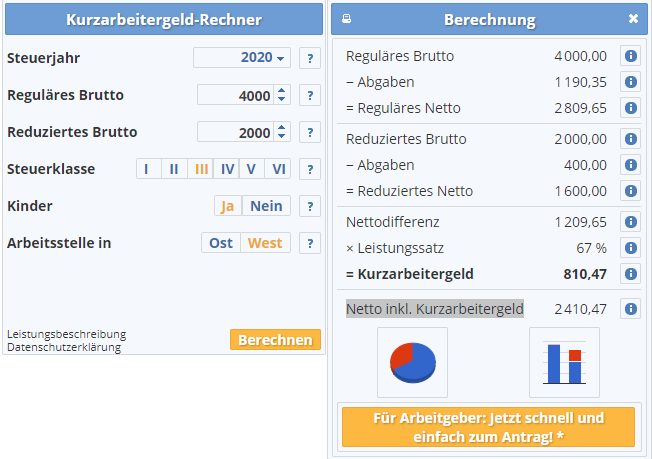

Let us use any standard tool to evaluate your net income under Kurzarbeit system.

- Open smart rechner tool in your browser as here.

- Select the year of tax (Steuerjahr).

- Enter your Original Brutto income (Reguläres Brutto).

- Enter your new Brutto income due to Kurzarbeit (Reduziertes Brutto).

- Enter your Tax class (Steuerklasse).

- Select whether you have children (Kinder) as Yes (Ja) or No (Nein).

- Select whether your Job location (Arbeitsstelle in) is in East (Ost) or West Germany.

- Click Berechnen button to find the total net income as Netto inkl. Kurzarbeitergeld.

Sample Calculation

Let us say you have a monthly Brutto income of 4000 € (40 hours/week).

If you are married with children, for tax class III (married),

Netto income /month = 2809.65 € (approximately).

Now your company decides to get into Kurzarbeit system and

your new Brutto income is 2000 €/ month.

New Netto income/month = 1600 € (approximately)

Difference in Netto = 2809.65-1600 = 1209.65

Federal employment agency contribution (Kurzarbeitgeld)

= 67 % of 1209.65 € = 810.47 €.

Final Netto income/month in Kurzarbeit system :

Netto inkl. Kurzarbeitergeld = 1600 + 810.47 = 2410.47 €

Final salary under kurzarbeit:

Reduced netto salary + 60% of difference of (initial netto salary- reduced netto salary) . And, netto amount changes proportionately to the tax class and income etc.

for e.g. for 50% kurzarbeit from 4000 € to 2000€ , 2410.47/2809.65 = approx. 86 % ( and not 0.5 + 0.67*0.5 = 83.5%).

for 80% kurzarbeit:

2658.16 €/2809.65 € =approx. 94.6 % (and not 0.8+0.67*0.2 = 93.4 %)