Free Statement of Contribution to the Deutsche Rentenversicherung

A statement from the Deutsche Rentenversicherung (German Pension Insurance) about your paid contributions to the German public pension insurance is required while applying for German permanent Residence permit. You can apply it online for free of cost with following steps:

- Click the following link to redirect to official website of Deutsche Rentenversicherung.

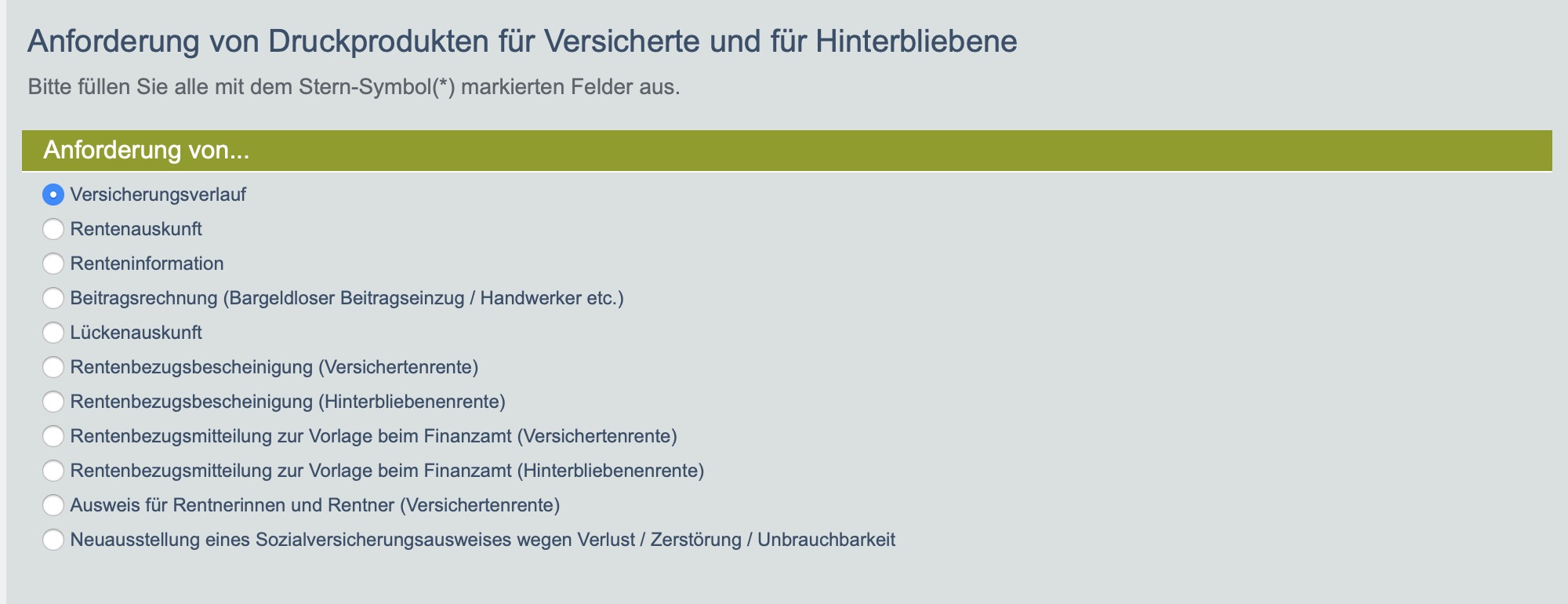

- Select the option Versicherungsverlauf to request for your statement of contribution towards German Pension Insurance.

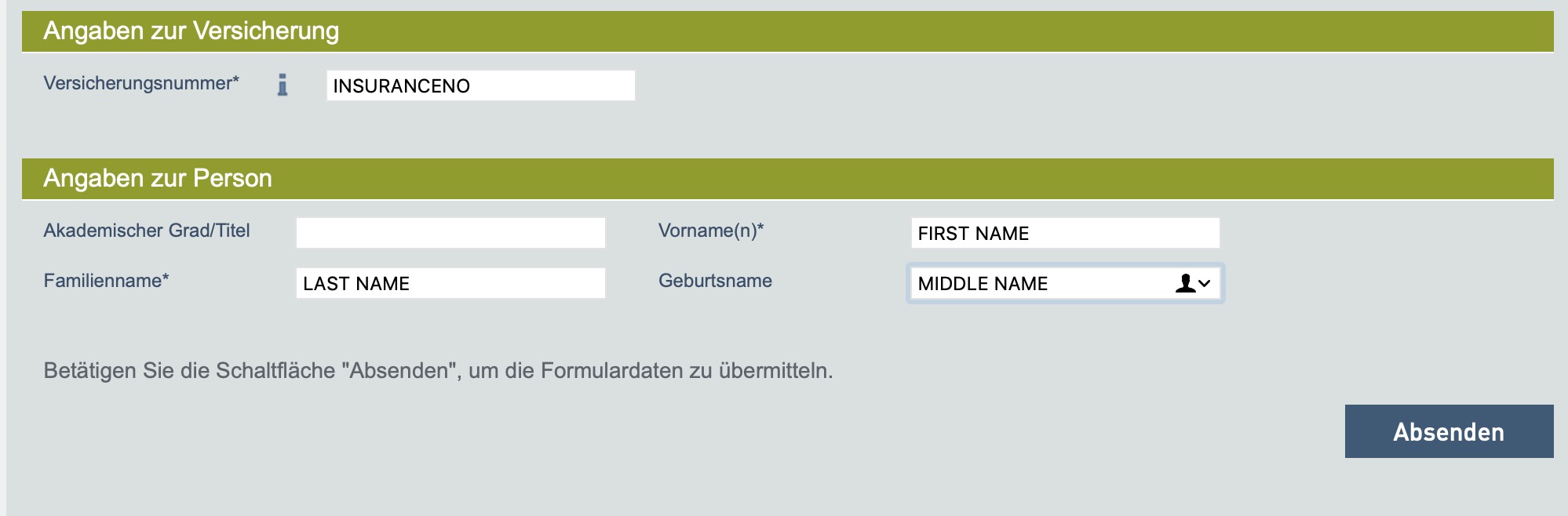

- Enter your Versicherungsnummer (Insurance number)- You can find it as SV-Nummer in your salary receipt.

- Enter other personal details – Vorname (First name), Familienname (last name) and click Absenden button to send the request.

You can expect the document in less than one month at your registered address via post. It contains your pension contribution report for the period-

- from the month of beginning of your first employment in Germany till last December, or

- from the month of beginning of your first employment in Germany till the month of termination of your last employment.

Know More: How to apply for Pension Refund on leaving Germany

Eazyleben Tips

- If your report is short of the required period (21/33 months or 5 years), then you can submit your salary receipt for the missing period. for eg. if you start your first Job in July 2017 and you request for pension report in July 2019 (after 24 months), then the pension report covers the data only up to December 2018 (only for 18 months). Then you can submit your salary receipts for the period of January 2019-March 2019 to complete 21 months pension contribution report.

I need the employer identification number for: Deutsche Rentenversicherung for tax purposes.

You can refer to Personal- Nr on your salary reciept (see first row, 1st entry) as the Employer Identification Nr.

Can we use the retirement insurance from our home country as proof in addition to the German one? I have only a few months of German Renteversicherung but more than 10 years of retirement insurance in the States.